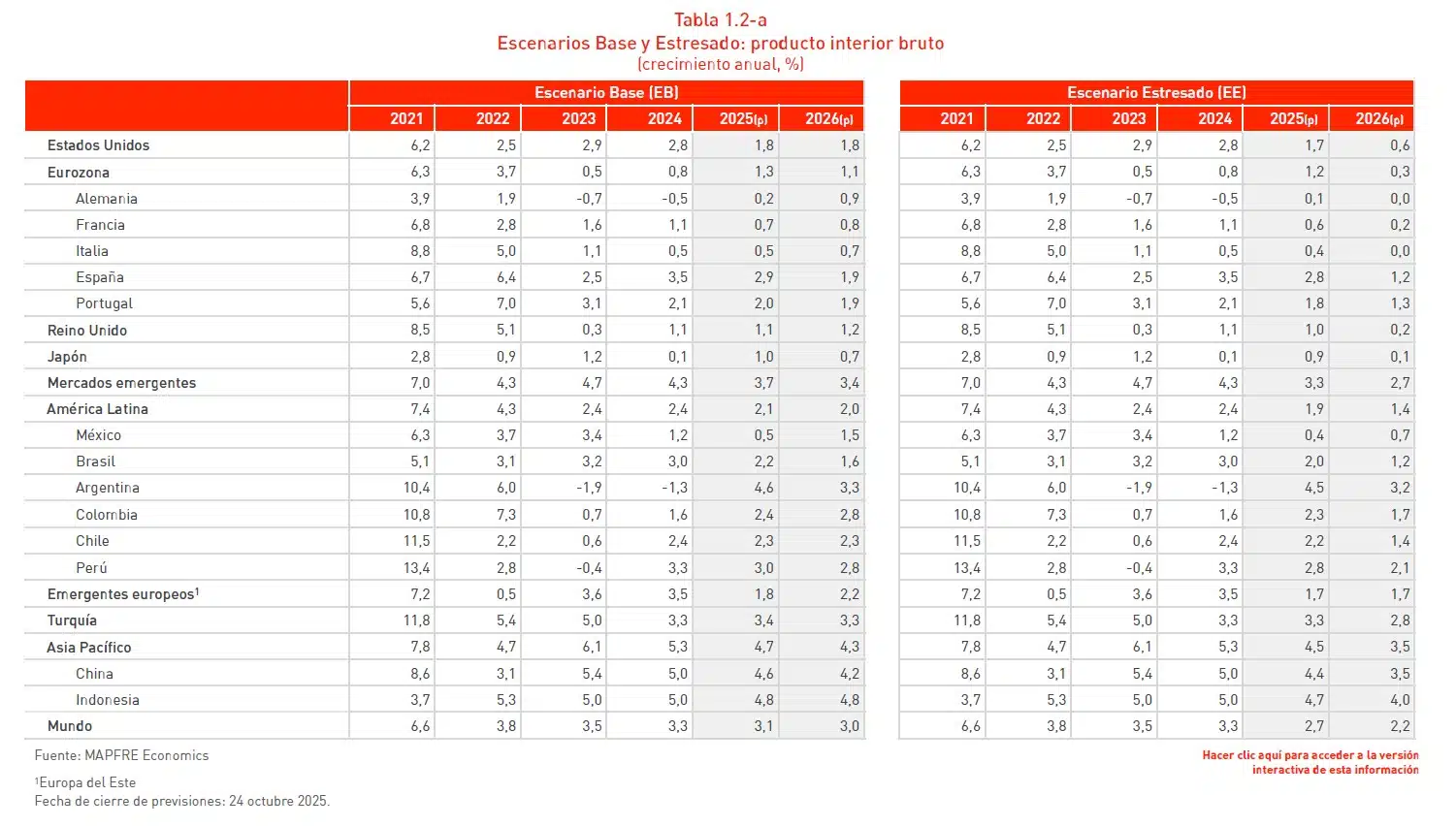

Mapfre Economics, Mapfre’s research arm, has raised its global growth forecast for this year by two tenths to 3.1%, while maintaining the 2026 projection at 3%, according to the report Economic and Industry Outlook 2025: Fourth-Quarter Update, published by Fundación Mapfre. Meanwhile, the global inflation forecast remains at 3.4% in 2025 and is expected to decline to 3% in 2026.

The baseline scenario presented in this report continues to reflect the central idea of a cyclical slowdown and moderating inflationary pressures, with the impact of tariffs expected to remain limited in 2025 and become more evident the following year. It is also worth noting that global uncertainty has declined significantly in recent months.

“The growth trajectory has remained solid, once again surpassing the risk outlook that had threatened a sharper slowdown, and showing that flexibility and adaptability are two of the defining features of the current cycle,” Mapfre Economics notes in the report.

The growth forecast for the U.S. economy improves by one tenth to 1.8% for this year—the same rate expected for next year—with inflation projected at 3% and 2.6%, respectively. The Eurozone forecast also improves by three tenths to 1.3% in 2025, while the 2026 forecast remains at 1.1%. Inflation is expected to stand at 2.1% and 1.8%, respectively.

Latin America is expected to post GDP growth of 2.1% in 2025 and 2% in 2026, with average inflation of 8.8% and 8.1%. Emerging markets as a whole are projected to grow 3.7% this year and 3.4% next year, with average inflation of 4.1% and 3.8%, respectively.

Finally, growth in the Asia-Pacific region is expected to reach 4.7% this year and 4.3% in 2026. China’s economy is forecast to expand by 4.6% in 2025 and 4.2% in 2026, with inflation of 0% this year and 0.8% next year.

Impact on the insurance industry

The insurance industry continues to demonstrate its ability to adapt to the new environment of geopolitical uncertainty, with growth in insurance activity levels revised slightly upward in this report. Overall, insurance activity will continue to be supported by a resilient economic backdrop, improved financing conditions in major markets, and a contained inflation environment.

Accordingly, both economic growth and interest rate levels will continue to support the global development of the insurance industry—both in the Life segment, expected to grow 6.2% this year and 6.5% next year, and in the Non-Life segment, projected to rise 5.4% in 2025 and 5.6% in 2026.

You can read the report here.