INNOVATION | 10.22.2025

Our time at ITC Vegas 2025

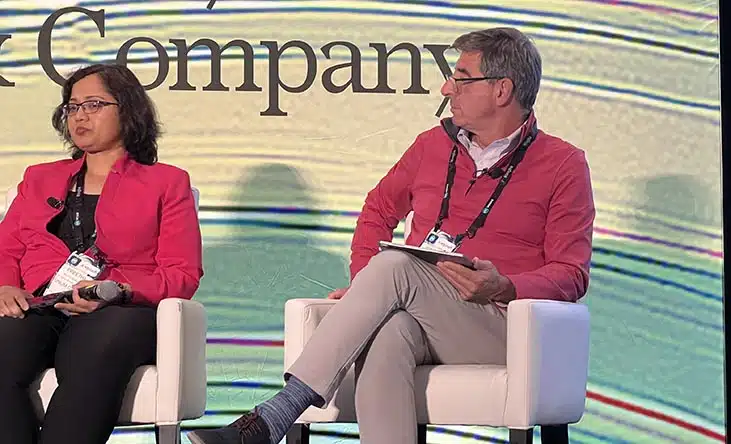

Carlos Cendra, Scouting & Investment lead of corporate innovation at MAPFRE, José Luis Bernal, Chief Digital, Data, and Innovation Officer at MAPFRE USA, and Anurag Bairathi, Chief Claims Officer at MAPFRE USA, participated in several panels to analyze the impact of generative AI, data, and social impact partnerships in the insurance industry.

For the second consecutive year, MAPFRE was the only Spanish insurance company present at ITC Vegas, the largest insurtech innovation event in the insurance industry in the world. With more than 10,000 attendees, professionals from the Group participated in presentations and panels where they analyzed the impact of generative artificial intelligence (Gen AI), data, and collaboration in the growth of the industry, from improving claims management to the development of much more strategic innovation projects with a tangible impact on the business.

MAPFRE's commitment to this space is no coincidence. The insurance company has been positioning itself for years as a leader in the transformation of the sector, betting on transversal and open innovation models, as well as enhancing areas such as operations, technology, data and AI, and cybersecurity to continue taking care of people.

Social impact partnerships to protect those who need it most

Insurance penetration is the ratio of gross insurance premiums to a country’s gross domestic product (GDP). Raising this level of penetration has long been a challenge for the sector in Latin America. While in the United Kingdom and the United States it stands at 12.5% and 11.8% respectively, placing them among the highest-ranking countries, in Latin America it’s only 3%.

Carlos Cendra, scouting and investment lead at MAPFRE, delivered one of the main presentations at ITC Latam – the segment of the event focused on this region – to analyze how social impact partnerships can help reduce the insurance gap.

He noted that “factors such as low economic growth and inequality in countries, limited access to insurance, insufficient financial and insurance education, and regulatory differences are barriers to boosting insurance penetration.”

In this context, social impact partnerships, like the one recently announced by MAPFRE with Blue Marble, are seen as essential to improving these figures. Specifically, the MAPFRE expert explained that “designing specific products and services for vulnerable groups, as happens with parametric insurance, amplifies reach. Likewise, aggregators like cooperatives can help increase understanding of the offering and its value. And we mustn’t forget that the industry has to commit to commercially viable products that ensure continuity in the future to build real stability.”

In a panel discussion, Cendra, along with Jaime de Piniés (CEO of Blue Marble) and Hugues Bertin (CEO of Digital Insurance Latam and president of the Pan-American Insurtech Alliance), debated why parametric insurance is so beneficial in this scenario and how social innovation can ensure sustainable, inclusive, and responsible growth of the industry and, consequently, the socioeconomic environment it impacts.

“Parametric insurance represents a viable alternative in terms of helping disadvantaged populations in Latin America, thanks to its ability to offer quick, efficient, and tailored solutions to the specific needs of these communities, especially in contexts of high vulnerability to climate risks and natural disasters,” said Cendra.

MAPFRE has been signing agreements for years specifically designed for vulnerable groups and disadvantaged populations. The multinational has extensive experience in traditional insurance such as microinsurance and assistance, among others.

“Joining the Blue Marble consortium is a very deliberate decision to complement the reach we already have with solutions that, until now, we hadn’t fully established but had tested. Parametric insurance is a great option to help us expand our portfolio of coverages and services and reach a larger number of people who need them,” the expert added.

Technology and data as a strategic lever

José Luis Bernal, Chief Digital, Data, and Innovation Officer at MAPFRE USA, delved into the challenges and lessons learned brought about by the rise of generative AI. Specifically, the manager highlighted that generative AI is enabling an improvement in internal processes, as well as in customer service.

Among the key takeaways, he highlighted that the success of these capabilities is only possible if people are involved (human in the loop), the data is curated and of high quality, and AI is used judiciously. “We rely on our own developments led by internal talent, but also form partnerships with those providing solutions tailored to the identified problem,” he noted.

Regarding talent, he emphasized that “today, learning something new is not very complicated; we have more than enough resources available for that. What we must do is ask ourselves how we motivate people to become small entrepreneurs in order to create more value for us as a company, and also for customers.”

Regarding measuring innovation, the expert from MAPFRE explained to the audience that MAPFRE already has reached over 4.4 million customers, the Group’s primary KPI for measuring the efforts undertaken over the past seven years. With the strategy and the current innovation model, “our KPIs are determined based on the innovation horizon we are working on. For those closest to our core business, we have ROI indicators that we define based on the circumstances of the project and its type. In cases where we talk about deployments or scalability, we share the KPIs with the business or operations team we are working with,” he stated.

Anurag Bairathi, Chief Claims Officer at MAPFRE USA, participated in a roundtable where he discussed automation and digitization with the aim of making better decisions and providing a more enriched customer experience. In this area, the focus has been on claims, examining how to make better decisions, process payments more quickly, and leverage technology to achieve these goals.

“Appraisers spend two-thirds of their time collecting and organizing information, and only one-third making decisions that actually help and support customers, which is really the core of any claim. By using technology, we can change this—minimizing administrative work and using that time to provide better service and attention, while also improving the employee experience in performing their duties,” he stated.

RELATED ARTICLES: