The insurance sector as an ally in mitigating climate risks

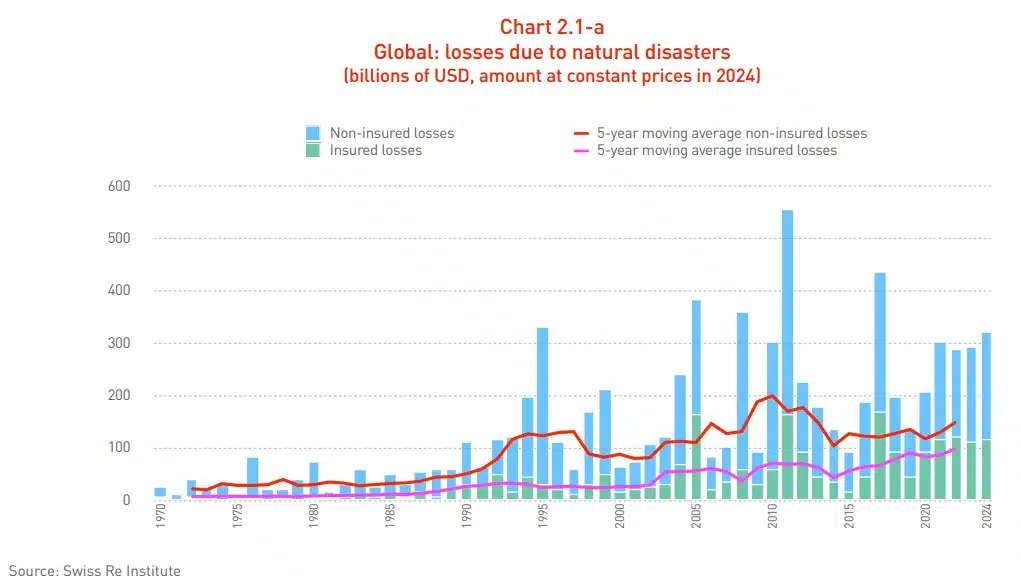

However, there is still a significant part of the world that is not covered against the effects of climate change, as highlighted by MAPFRE Economics in the report ‘Climate change, extraordinary risks, and public policies,’ presented in the framework of COP30. In fact, global natural disasters caused economic losses in 2024 that reached at least US$368 billion (US$397 billion and US$365 billion in 2023 and 2022, respectively).

In the insurance industry, the portion that is not covered is reflected in the natural catastrophe protection gap (“NatCat gap”), which can be defined as the difference between the total economic losses caused by natural catastrophes and the losses that are covered by insurance contracts.

If the information is analyzed by region, taking the average of the last available decade (2015–2024), Asia is the region of the world with the largest insurance protection gap, with coverage of only 17.2% of total losses from natural catastrophe-related risks, representing a gap of 82.8%. Next is Latin America, which has an average gap of 81%. On the contrary, North America is the region that presents the smallest protection gap, with an average of 43.2% of losses not covered by insurance contracts.

“Asia’s lack of protection against natural disasters stems primarily from the rapid growth and population density of its cities, combined with the accumulation of assets at risk from weather phenomena such as floods, which tend to be relatively less insured than wind,” highlights MAPFRE Economics in the report.

Among all the adverse effects of climate change, MAPFRE Economic Research emphasizes flooding. These are the natural threats that impact the largest number of people globally: it is estimated that approximately 29% of the world’s population resides in areas exposed to this risk, and they are responsible for more than a third of the natural disaster-related deaths since 2011. Likewise, it is estimated that floods caused damages of around US$496 billion between 2013 and 2022, with an insurance coverage deficit of 80.6%.

In light of this increase in major disasters, the insurance industry has had to adapt its business model, with strategies that include advanced risk assessment using technologies such as big data analysis and artificial intelligence, as well as the launch of new products, such as parametric insurance.

Reinsurance, fundamental in climate risk management

Reinsurance plays a fundamental role in managing climate risks, especially in a context where extreme events are increasingly frequent and unpredictable. This tool allows insurers to transfer part of their risks to other specialized companies, ensuring the financial stability of the sector and the continuity of coverage for the insured parties.

The activity volume of the global reinsurance market has grown significantly in recent years, reaching US$900 billion in gross premiums by the end of 2023 and more than US$630 billion dollars in net premiums.

In recent years, and in light of the increase in natural disasters, reinsurers have freed up balance sheets through the securitization of catastrophe bonds. Having emerged in the 1990s, these bonds are financial instruments used to transfer risk from the insurance industry to other investors and represent an additional and complementary reinsurance protection alternative for insurance companies.

What measures can we take to mitigate the effects of climate change?

Closing the insurance protection gap for catastrophic risks is a public policy challenge that must be addressed from multiple perspectives and requires coordinated action by insurance companies and other stakeholders at all levels of government: local, national, and international. Thus, the MAPFRE Economics report recommends leveraging the following:

- Public–private insurance partnerships for climate disasters: developing collaboration frameworks between public authorities and the insurance industry to manage and share disaster risks.

- Incentives for preventing and reducing risks from adverse climate phenomena: using insurance as a tool to encourage risk-reduction measures and integrating insurance into broader climate-adaptation and disaster-risk-management efforts, early-warning systems, and the transfer of risk to capital markets.

- Measures related to the collection and management of catastrophic loss data: improving risk data, models, and pricing strategies.

- Measures aimed at expanding coverage through parametric solutions: broadening coverage through combinations of parametric (index-based) insurance solutions together with conventional insurance.

RELATED ARTICLES: