Microinsurance is a tool that provides financial protection to vulnerable communities. In this article, we’ll learn about what microinsurance is, its benefits, where it’s mainly used, and some specific examples of how it’s making a positive impact on people’s lives.

What is microinsurance?

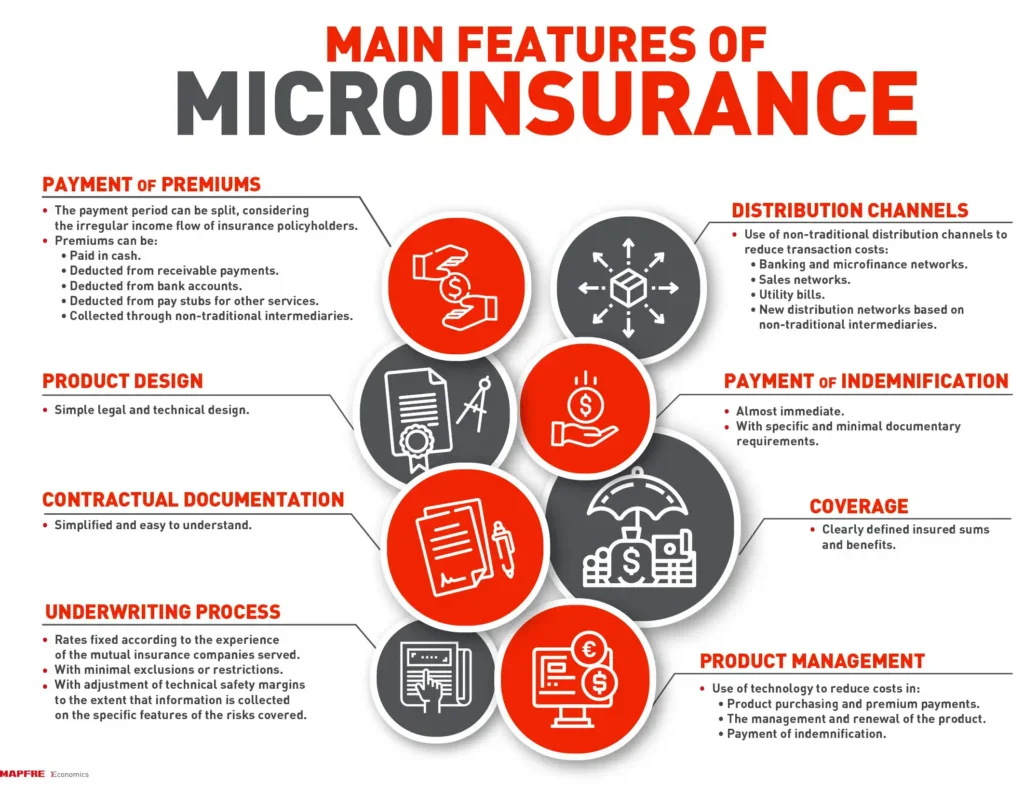

Microinsurance are insurance products designed specifically to meet the needs of low-income populations or people with limited access to certain financial services. These insurance products offer coverage for specific events that can affect people’s lives or livelihoods, such as diseases, accidents, and natural disasters, among others. Target populations can easily access and use it due to its simple underwriting, claims processing, and paperwork.

Benefits of microinsurance

- Financial accessibility

Microinsurance is an affordable option for people with limited incomes, which in some cases can be taken out for rates as low as 1 euro per month, depending on the coverage. This allows them to access a financial security network that would otherwise be beyond their reach.

- Protection against Specific Risks

It offers private coverage for situations such as illness, accidents, and natural disasters, among others. This allows many people to mitigate the financial risks associated with unexpected events.

- Easy access and use

Simple underwriting and claims processing makes microinsurance easy to understand and use, which is crucial for populations that may not be familiar with technical terms or complex processes.

Where microinsurance is most needed

This type of insurance plays a crucial role in developing economies, where social security networks may be limited, thus providing an additional layer of financial protection. This is the case of microinsurance in areas of Colombia or Sub-Saharan Africa, for example. It focuses on prenatal and maternal care and protects women during breastfeeding, which has been demonstrated to improve maternal and neonatal health outcomes. Microinsurance is also essential in regions prone to natural events such as earthquakes, floods, and hurricanes, as it helps communities recover more quickly and rebuild their lives. Asia is another example, a place where microinsurance adapts to the needs of farmers, providing financial stability to agricultural communities and ensuring that their efforts are not compromised by unforeseen events.